Overview:

Vesto offers businesses a turnkey blockchain infrastructure to safely scale into the future of digital assets. Its easy-to-use yet powerful gateway into the blockchain and digitized asset ecosystem transforms how organizations transact business, store, market, and transfer digitized assets, and earn yields. With a single secure sign-on using multi-sig encryption keys, Vesto’s customers can deposit assets into a smart VWallet,1 exchange and transfer assets to and from that VWallet, utilize smart contracts to sell or buy assets, and send remittances or make payments globally, all at a small fraction of previous costs and taking only seconds to complete.

Vesto utilizes fully asset-backed US Dollar-linked USDC Stablecoin as its basic crypto asset, thereby protecting customers from the price volatility seen with other cryptocurrencies. Vesto customers own and control their own VWallet and the assets they deposit and invest through Vesto. They can always transfer or withdraw these assets and exchange the USDC in their VWallet 1:1 for cash. Additionally, Vesto does not lend money or invest on margin. These attributes are structural safeguards protecting Vesto and its customers from the recent crypto company failures caused by their liquidity being dependent on unsustainably high cryptocurrency prices or highly leveraged loans, or by their clients’ assets being used as collateral by, or commingled with accounts owned by, the company or its executives.

Vesto’s unique multi-chain, multi-token protocol utilizes Ethereum and Polygon, making Vesto’s transactions faster and their cost significantly less than other blockchain solutions. Vesto is designed to enable Vesto’s users to earn higher yields from both decentralized finance (DeFi) and centralized finance (CeFi) services. Vesto’s combination of a robust proprietary blockchain protocol, a cloud container of application services, unique client apps, SDKs and APIs, and a best-of-breed partnering strategy, assures that Vesto’s customers will have access to the most up-to-date and cost-effective DeFi and CeFi services, decentralized applications (dApps) and blockchain protocols. Its white-labeling and customization options make Vesto the perfect solution for a wide range of applications, industry verticals and use cases.

Introducing Vesto:

Vesto is the turnkey blockchain infrastructure for businesses to safely scale into the future of digital assets. It’s a comprehensive, multi-chain, multi-token protocol that provides fast, reliable, and global access to today’s most advanced crypto banking, transaction, and yield generation platform. Vesto customers have continuous, convenient access to a highly efficient transaction engine, encrypted accounts, uniquely robust DeFi and CeFi partners, and a blockchain infrastructure to tokenize assets, manage smart contracts, and maximize potential gains on all their marketable digital assets.

Dedicated to supporting its customers’ regulatory compliance needs, Vesto incorporates the advanced security, know your customer (KYC), know your business (KYB), and anti-money laundering (AML) controls, and supports all the record keeping and reporting capabilities, that regulators typically require for financial institutions. By incorporating these controls, Vesto can offer its customers access to permissioned blockchain DeFi and CeFi products where all participants must undergo KYC, KYB and AML verification, as well as access to permissionless DeFi products where participants may or may not have undergone KYC verification. Like most financial institutions, Vesto supports B2B, P2P, B2C and C2B transfers2, as well as domestic and international remittances.

Vesto’s offering includes multi-sig identity verification and the ability to onboard multiple selected fiat currencies. Vesto can also onboard the US Dollar-linked stablecoin USDC and other selected ERC-20 compliant tokens, and has the ability to add a variable list of additional digital currencies and tokens as needed. Internally, Vesto converts onboarded fiat currencies and other digital currencies into USDC which can always be exchanged 1:1 for cash. Using fully asset backed USDC as our base asset assures value stability for day-to-day transactions on a mass scale.

Additionally, Vesto’s VWallet is a non-custodial smart wallet, meaning Vesto provides custodial governance, multi-sig access controls and administrative services, but customers own the account and retain unique private keys, giving them complete control over their assets deposited with Vesto.

Finally, Vesto’s fees are a small fraction of the variably cited 2 to 4% for domestic credit card transactions, the extra 1 to 3% or more for international transfers, the 4 to 7% for cross-border cash remittances; and up to 6% for property sale commissions and 30% or more in art sale royalties. Vesto opens up the global market of DeFi and CeFi opportunities to its customers, giving them the ability to efficiently transact business worldwide, and gaining them sales opportunities and earning yields on their assets that were previously only available to the most sophisticated of international traders and investors.

Vesto records all deposited assets and processes all its transactions on-chain3, resulting in permanent, immutable blockchain records of these exchanges, and Vesto provides an encrypted customer-controlled process to recover lost keys for their accounts. Its unique multi-chain protocol and multi-token architecture can secure customer’s deposited assets in their Ethereum-based custodial VWallet, while creating corresponding newly minted ERC-20 compliant VTokens 4 in their Polygon-based VWallets. This chain-bridging process, combined with Vesto’s asset pooling and block transferring process, greatly increases transaction speeds and significantly reduces blockchain gas fees. Using Vesto’s VTokens, Polygon’s proof-of-stake (POS) consensus algorithm, and Ethereum’s new POS processes are also much more energy efficient than cryptocurrencies and blockchains using proof-of-work (POW) processes. When a customer requests the withdrawal of some or all of their assets from Vesto, the assets in their Ethereum-based VWallet needed to execute that withdrawal are unlocked and made available. The VTokens in their Polygon-based VWallet that correspond to those unlocked and withdrawn Ethereum-based assets are burned, as are any corresponding tokens invested in Vesto’s DeFi and CeFi options. The total assets available to a Vesto customer from their VWallet for withdrawal, transfer, or reinvestment on any given day will be a function of their accumulated deposits and transfers in, withdrawals and transfers out, investment gains and losses, and valuation changes of held digital assets.

Vesto’s process of mirroring customers’ assets on multiple ledgers is similar to how banks hold clients’ deposits in the clients’ savings account ledgers, while also pooling those same assets to earn the bank money in their own loan and investment accounts. The difference is, with Vesto, users own and control both their underlying assets on Ethereum, and their VTokens on Polygon. In addition, Vesto’s customers own and control their DeFi and CeFi investments which typically earn users much higher yields than bank accounts. The investment and allocation strategies used by our DeFi and CeFi partners have historically resulted in average annual percent yields (APYs) of 3% to 20% or more depending on the options selected and their then current yields.

One of Vesto’s founding principles is to own and control its own root source code and related technology. This includes a design for extensibility to, and integration with, best-of-breed partners; as well as a development portal with API documentation which serves as a hub for others to integrate with Vesto. This gives Vesto a unique flexibility to quickly adapt to fulfill its customers’ changing market needs and to continuously add the latest crypto, digital asset, and application service solutions. As an enterprise-ready platform, Vesto’s technology easily integrates into customers’ banking and business systems and it can be white-labeled and customized as needed, as can Vesto’s user-facing portal and mobile apps.

All individual, retail, and institutional interfaces incorporate the latest intuitive and user-friendly UI/UX design and underlying technology to make transactions using Vesto easy, safe, and quick. This flexibility, functionality and ease-of-use opens an almost endless array of use case applications within multiple industry verticals. This same flexibility means Vesto can support an increasing range of fiat currencies, crypto coins, tokens and blockchain platforms; and can mint and transact with VTokens representing a broad array of assets.

Further, given the extensive time commitment and talent needed to develop, code, and build Vesto’s platform and its complex multi-layered components and functionality, businesses with complementary products, and even some potential competitors, are realizing their best path to success is to simply license and white label Vesto as a foundation for their use cases.

Finally, regardless of the Vesto customer or business partner through which end-users access Vesto’s platform, it can democratize access to global financial opportunities and yields previously only available to a select few. Its low cost and accessibility enable millions of individuals who are currently under-banked to access these benefits, including the ability to send international remittances in seconds, 24/7, with few intermediaries, and at a fraction of previous costs.

The History of Vesto:

The history of Vesto began in late 2018 in San Francisco, which had become a hub of exploration and innovation in the new field of cryptocurrency and blockchain technology. It was there that Vesto’s CEO and co-founder, Chris McGregor, developed his passion for the power of this technology, DeFi and digital currency. He left his job as senior software engineer for a start-up developing adaptable business-ready blockchain protocol and ventured out on his own, driven by his conviction that blockchain technology would eventually transform the way business and banking is conducted, and determined to help make that happen.

Chris is a successful entrepreneur, a full stack developer, and a named inventor on numerous issued patents. His developed technologies include BT Cellnet’s original Pay & Go solutions for 3G/4G LTE mobile, mobile authentication for the US Federal Government, and prototypes of the first ISO biometric powered card (now being offered by MasterCard internationally). Two of the companies Chris co-founded and developed with his brother, Travis McGregor, were particularly successful. Their Telemac Corporation achieved over $100 million in revenue with over 20 million mobile devices licensed and deployed by 17 mobile phone manufacturers prior to its intellectual property assets being purchased by Tracfone, the largest prepaid mobile services provider in the US, in 2009. Their Q Technologies intellectual property assets were sold to RootMetrics, the largest and most trusted QoS/QoE monitoring company for 4G LTE and 5G packet-based mobile networks in the US, in 2015.

These entrepreneurial successes allowed them to self-fund what ended up being a multi-year effort developing the vision and business model for Vesto, and the core code for the platform, VWallet and DeFi protocol. Once Chris wrote the core root code and product strategy and was comfortable that it was sound, he and a small team of trusted colleagues founded Vesto in September of 2019, initially incorporating in Wyoming because of its favorable treatment of blockchain and cryptocurrency companies at the time.

With Chris as Chief Executive Officer (CEO), Vesto’s other co-founders include his twin brother, Travis McGregor, who brings over 25 years of experience in senior sales, marketing, and business and product development roles, and co-founded with Chris, several of his previous start-ups. Co-founder Wolfgang Decker brings over 30 years of experience as a consultant and business executive in Germany and the European Union assisting multiple businesses through high tech and digital transformation, novel digital business models, and product and service go-to-market strategies. Wolfgang is also a Professor at Hochschule der Bayerischen Wirtschaft (HDBW), a business administration and engineering university in Munich, Germany. Co-founder Jeff Lund, brings over 13 years of experience as a web developer and manager of coding and digital media production for multiple companies, including two of Chris and Travis’s other start-ups. And finally, Head of Operations of the start-up, Erin Dobratz, brings 4 years of experience as COO of a social commerce startup and 9 years of experience as product manager at CBS Interactive and CNET Networks, including managing the team who initially developed CNET’s iOS app for iPhones and iPads. She also brings great teamwork skills as evidenced by having won multiple medals on the Stanford University and U.S. Synchronized Swimming Teams, including an Olympic Bronze.

Since the company’s founding, Vesto’s team of managers, staff members, coders and advisors has quickly grown to include a wide range of professionals, each bringing an impressive range of successful backgrounds and skills. Vesto’s initial executive team has also evolved as the company has grown. For more on Vesto’s senior team members, visit https://vesto.io/about-us.

When Chris and Travis McGregor and Vesto’s other co-founders surveyed this marketplace in 2019, they found each of their potential competitors that offer crypto-affiliated products and services were largely focused on one or two purposes or functions, and their user interfaces were typically difficult to navigate. Even those offering multiple functions often focused on a single industry vertical or use case. For example, they may offer a digital wallet, but only for the exclusive purpose of depositing, purchasing, selling, transferring, or storing digital assets for use in their crypto exchange. Users typically had to establish accounts with multiple companies and sign on separately to access different desired functions, with little ability to automatically integrate all their crypto-related activities. Further, despite cryptocurrency operating on distributed ledgers or blockchain technology, many companies conducted much of their business off-chain, holding at least some records in off-line and vulnerable databases, and they often did not include the KYC, KYB, and AML checks to verify the identities of those involved in business transactions; practices that can lead to the loss of accurate, auditable records and a lack of transparency regarding the value transferred, who was involved, and where and when the assets were sent.

The Vesto team was determined to build a full-service blockchain-enabled transaction platform that would usher in a new era for finance, banking and commerce, making participation in the evolving digital asset ecosystem safe, user-friendly, and easily available to everyone from multinational corporations to local businesses and their end-users. This overarching goal led to the establishment of Vesto’s 6 guiding principles, shown in the chart below.

VESTO’S GUIDING PRINCIPLES

- Inclusive: Democratize blockchain technology and crypto-enabled opportunities, ensuring their accessibility to all types and sizes of businesses and their end users.

- Easy to Use: All customer and user interfaces to be easy to use, intuitive, and customizable to meet customers’ unique needs, with all assets kept safe and secure.

- Always On-Chain: All transactions done on-chain, assuring transparency and accuracy, and preserving an immutable record of Vesto exchanges involving customers’ assets.

- Own Our Own Core Code: Develop, own and control our own root source code and related technology, assuring our unique value and our flexibility in responding to customers’, partners’ and the marketplaces’ changing needs.

- Provide End-to-End Solution: Provide a comprehensive, integrated, and trustworthy platform of services and functions through one secure sign-on, including best-of-breed partner protocols, all with white-labeling and customization options.

- Support Regulatory Compliance: Support customers’ regulatory compliance with KYC, KYB and AML verification, and on-chain records and reports.

By early 2020, Vesto’s platform was sufficiently developed to begin discussions with potential customers and with business partners who could bring important features to the platform. The positive feedback received from best-in-class companies in the crypto business, and their eagerness to partner with Vesto, confirmed that the platform was years ahead of the competition. The company’s early partnering decisions have proved their value in the years since. For example, Vesto’s partnership with Circle and the use of their fully asset-backed USDC as our base cryptocurrency stablecoin underscored the value of our best-of-breed partnering strategy in mid-2022 when the value of many cryptocurrencies crashed, but the US Dollar-linked value of USDC remained generally stable. And, the decision to create a flexible multi-token, multi-chain protocol and partner with Polygon to lower the cost and time involved in transactions helped make Vesto an extremely cost-effective vehicle for conducting business on blockchain, and uniquely positioned to support applications with high-volume microtransactions.

Even after Ethereum’s recent move to more efficient POS transaction processing with Ethereum 2, Vesto’s use of Polygon and VTokens still delivers significantly lower gas fees and transaction times, and virtually eliminates the high fees and longer delays due to network congestion common with Ethereum. For example, gas trackers at the time of this writing show the average gas fees and transaction times for simple digital coin transfers on Ethereum 2 measure in multiple dollars and multiple minutes, while Polygon’s measure in fractions of a penny and a few seconds. Paying $5.00 or more and taking 3 minutes or more on Ethereum 2 might not matter to a bank executing a single transaction worth thousands of dollars, but it's prohibitively high for low value transmissions and the delays are problematic for most point-of-sale applications. In addition, Vesto’s ability to bundle multiple transactions into a single blockchain contract, further improves its cost and time advantages.

Separately, Vesto’s investment of the time and expense required to successfully complete a comprehensive code audit by highly respected ChainSecurity, based in Switzerland, has proven to be a valuable source of comfort for potential customers in this time of increased concern about security and reliability.

Vesto’s dedication to being a flexible, comprehensive solution was further demonstrated in mid-2022 when permissionless DeFi yields dropped from a historic average annual percentage yield (APY) ranging from 5% to 20%, down to an APY of 2% to 3%. Vesto responded by adding a new CeFi investment option for our customers which offers an APY of 7% or more at the time of this publication. Given the large difference in yields, Vesto currently makes this CeFi product the automatic default option for Vesto’s customers. Vesto’s CeFi partners are regulated financial service companies which act as trusted intermediaries and add high quality traditional investment opportunities to our customers’ investment portfolio, while still including exposure to some high quality DeFi investments. Our CeFi partners’ options are all permissioned, meaning they require all participants to be fully vetted and in compliance with KYC, KYB and AML verification standards. Further our CeFi partners utilize US Dollar-linked USDC stablecoins, and assure that both their CeFi and DeFi investments are permissioned, risk averse, fully asset backed, and have wide marketplace acceptance. Finally, Vesto’s default CeFi investment option allows customers to choose between open term contracts, or term contracts with maturities varying from 1 to 12 months. In exchange for producing increasingly higher yields, these longer-term smart contracts bar customers from withdrawing their investment before their maturity date. However, customers retain the ability to transfer these assets at any time. All these features make Vesto’s CeFi option perfectly suited for businesses’ and financial institutions’ asset management and corporate treasury functions.

Vesto also remains bullish on the future of the DeFi market and is planning to add new, next-generation permissioned DeFi partners which are regulatory compliant and produce much higher average yields than today’s permissionless DeFi options. Once one or more higher yielding DeFi options are integrated with Vesto’s protocol, we will begin offering our customers an exclusively DeFi choice, as well as our CeFi option (which currently also includes some permissioned DeFi exposure). Vesto is dedicated to continually updating our investment options to make sure they meet all our customers’ business requirements, yield aspirations, risk tolerances and compliance needs.

Vesto’s partners now include, among others: FinClusive (KYC/KYB/AML/KYT), Uniswap (crypto exchange), Pinfore (ATM offramp), Plaid (bank account data), Burling Bank (corporate treasury), FinClusive and Latamex (fiat on/off ramps), multiple crypto partners including Ethereum, Polygon, Chainlink, Circle and Maker, and multiple risk-averse DeFi and CeFi partners. The company is currently considering other secure, high performing partner relationships in the DeFi, CeFi and NFT ecosystems, and other applications where Vesto’s efficient tokenization engine can help businesses and their products join the blockchain-enabled digital age. Finally, as mentioned above, some companies with complementary products or who might have become future competitors are also considering partnering with Vesto. They realized that rather than continuing to invest time and money in building the capabilities Vesto delivers, they would be better served by collaborating with Vesto to integrate its platform or specific Vesto capabilities into their products and services. For more on Vesto’s technology, see the below section titled “Vesto’s Infrastructure.”

At the time of this publication, Vesto has piloted its platform with 9 businesses, and 4 customers have moved forward with full commercial license agreements. The use cases represented by these businesses include a fintech company delivering a crypto and cashless transaction platform with instant settlement to retail businesses across the US, including traditionally underserved businesses. Another use case involves delivering fast, low-cost remittance services while opening internet- and smart phone-based banking and financial services to underserved populations in the US and Latin America. A third use case involves using Vesto’s higher yielding DeFi and CeFi investment opportunities to improve the yields on businesses’ corporate treasuries and funds on hand from operations and transaction float. A fourth use case involves a traditional financial services company which proposes to use Vesto as the platform to market and distribute a new token that would be registered as a security with the SEC (US Securities and Exchange Commission) and fully backed by the assets in their traditional mutual fund investment portfolio. And a fifth use case involves businesses operating in Africa and the Middle East that would use Vesto for next-generation cryptocurrency-based international mobile money platforms.

Given this marketing success and the progress made on full implementations, Vesto is now beginning to accelerate its efforts to add new customers from the many prospects identified in Vesto’s CRM (customer relationships management) pipeline. The potential revenue from fees and from DeFi and CeFi deposits anticipated from these early customers will provide sufficient revenue to support Vesto’s initial business plans. It is currently anticipated that with this proof of concept, marketability, and revenue generation in hand, Vesto will seek to raise additional capital in the latter part of 2023 to support scaling up to Vesto’s true international potential. Chris’s vision of four years ago has become reality, with 2023 now seen as Vesto’s breakout year.

Vesto’s Infrastructure:

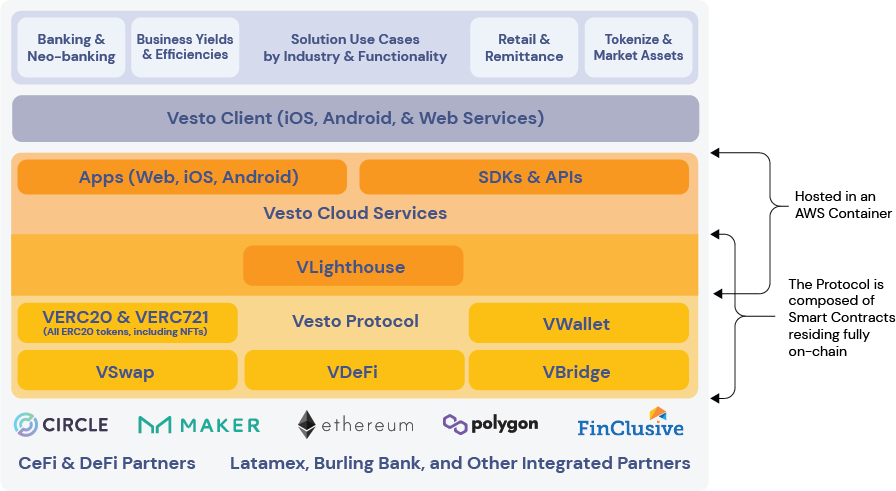

Vesto’s turnkey blockchain infrastructure can be envisioned as a layered stack of integrated components. The core of this infrastructure’s architecture consists of three tiers: the Vesto Protocol, Vesto Cloud Services, and the Vesto Client. Collectively, Vesto delivers a full stack of services that provide an end-to-end solution platform designed to be the foundation for any business to leverage any and all crypto-enabled services in an agile, simple, seamless, and scalable way.

The primary Vesto architectural layer is the Vesto Protocol. Like a diplomatic protocol for negotiating across disparate institutions and communication channels, the Vesto Protocol provides a set of discreet yet cohesive functions and services that allow for negotiation across varied blockchain protocols, crypto assets, and services. All business logic for providing and engaging crypto services resides in smart contracts written and controlled by Vesto which reside on-chain and can easily and reliably integrate and operate with multiple blockchains such as Ethereum and Polygon.

Vesto Cloud Services comprises the second tier of the Vesto architecture. All of Vesto’s software services reside in an Amazon Web Services (AWS) container which allows for easy and rapid deployment of unique instances of Vesto’s services for each of Vesto’s customers. This layer contains component applications services, including security, monitoring, and reporting services which are fully integrated with their counterparts in the Vesto Protocol to provide robust, enterprise grade services. The Vesto Cloud Services houses design templates, APIs and SDK tools which enable customers to quickly integrate with Vesto’s services through the Vesto Client, and to modify and white-label Vesto’s crypto services as an extension of the customers' own digital services architecture.

The third tier of the Vesto architecture is the Vesto Client. The key guiding design principle for the user experience is founded on ensuring each transaction is as simple as sending an email. Vesto provides white label mobile applications for both iOS and Android devices. In addition, Vesto has created a web services customer interface that is accessible through any common web browser. The primary component of the Vesto Client is the VWallet. Vesto’s user interface (UI) provides an intuitive, up-to-the-minute view of a customer’s and their end-users’ assets on deposit in their respective VWallets, as well as yield status and information on all their transactions executed through the Vesto Protocol.

Within this core architecture reside the many smart contract modules that constitute Vesto’s proprietary core code. They manage and integrate the other layered components comprising Vesto’s platform, including the protocols of Vesto’s best-of-breed partners, as well as the integrated elements of Vesto’s customers who represent a range of industry verticals and use cases. Vesto’s customers’ applications and use cases can be visualized as sitting on top of our core architecture and integrated with the platform through the Vesto Client and Vesto Cloud Services. Vesto’s partners and their protocols provide support for, and are integrated into, the platform through the Vesto Protocol. The three tiers of Vesto’s architecture are described in detail below, including how they integrate into Vesto’s Service Architecture.

Vesto’s Architectural Components

The Vesto Protocol

The Vesto Protocol consists of several native smart contract modules; VWallet, VToken, VDeFi, VBridge, and VSwap, all of which are deployed on-chain, primarily on the Ethereum protocol, to provide a broad array of crypto services as well as providing access and orchestration of functions of other blockchain protocols. There are also some composite services which have components residing in smart contracts on-chain, and others as software components residing in the Vesto Cloud Services. Composite services, such as VLighthouse provide visibility and control of end-to-end business services offered by Vesto.

The Vesto Protocol can support any ERC20 tokens. In addition, Vesto employs a multi-token process to mint VTokens on other blockchain protocols like Polygon, which are paired with a customer’s underlying base deposit held in that customer’s VWallet on Ethereum. This functionality enables Vesto to perform lower cost transactions more efficiently and create higher yield generation opportunities against customers’ underlying deposits. The multi-token process is made possible through the complementary set of smart contracts running within the Vesto Protocol. At a high level, VTokens and VSwap form the core of Vesto’s tokenization engine and orchestrate the minting and burning of tokens, while VBridge manages the cross-chain (i.e. L1 to L2) activity of crypto assets. VDeFi and CeFi manage the process of generating high yields by integrating with our yield producing DeFi and CeFi partners. VLighthouse provides visibility and control across the end-to-end business processes that are taking place – from Vesto Client, through Vesto Cloud Services and the Vesto Protocol. VLighthouse also includes our VWallet smart contract and multiple signature private key (Multisig) process described below, providing the highest level of authentication verification and an encrypted customer-controlled key recoverability process.

The Vesto Protocol has the capability of minting and burning not only ERC20 compliant tokens but other tokens as well, such as NFTs, which can be deposited into customers’ and their users’ VWallets. By design, Vesto does not intend to provide a cryptocurrency exchange for NFTs, but will focus on treating them as managed assets.

Vesto Cloud Services

Vesto’s AWS cloud container houses all the Vesto Client services, including API connection points, SDK tools and application templates. This layer of the architecture provides supporting software services for the business logic that reside on-chain in the Vesto Protocol. Dedicated instances of Vesto cloud services can be created for customers who want to develop white-label deployments of the Vesto infrastructure.

The AWS Cloud container not only provides secure and unique customer instances of Vesto services, but also offers automation and orchestration capabilities of AWS Compute, networking, secure storage, and other application resources needed to fulfill customers’ business application requirements. AWS can readily provide an easily managed cloud service for integration of Vesto’s platform with a customer’s own application ecosystem.

When deploying a VWallet, one private key is generated on the user’s personal secured device through a process that does not expose that newly generated key on any network. The address of that private key along with a second Vesto private key resides with AWS Key Management Services (KMS). Vesto’s Multisig process provides users the exclusive ability to deploy these keys to securely access their VWallets. In addition, Vesto’s protocol includes an encrypted process controlled by customers to recover their private key should it be lost. Attached to each entity’s private key is metadata that enables the assignment of roles to each entity that can be invoked to provide a layered authorization approach to executing transactions. More important or higher value transactions could be designed to be signed-off by certain types of personas, such as an administrator, and could even require multiple signatures to execute a single transaction.

Collectively, Vesto’s Cloud Services enrich and facilitate the customer experience when interacting with the services managed through the Vesto Protocol. These software services also can be leveraged by a customer to rebrand and integrate Vesto’s platform for incorporation into their existing and emerging application offerings. The Vesto Cloud platform enables developers to create custom interfaces through a published SDK which include several templates for customization.

The Vesto Client

The Vesto Client primarily provides the customer and their end users interfaces for their VWallets. The white labeled App can be installed through downloads from either the Apple Store or Android Marketplace. Vesto also provides a web services interface accessible through any modern browser. The VWallet user experience is designed for ease of use to allow the processes of making a transaction as easy as writing an email. Additionally, Vesto provides a developer portal with API documentation which developers can leverage for interacting with services of the Vesto Platform. Vesto’s platform can be white-labeled and customized and all of Vesto’s user-facing interfaces can be branded.

A customer can be issued more than a single VWallet and customers can create sub-VWallets which they can manage on behalf of their end users. In addition to providing the user interface for the VWallet, the Vesto Client is also integrated into Vesto’s proprietary process of generating their Multisig VWallets and private encrypted keys as discussed above. The Vesto Client is the secure end point for customers and their end-users to initiate transactions and view the status of all assets deposited in their VWallets.

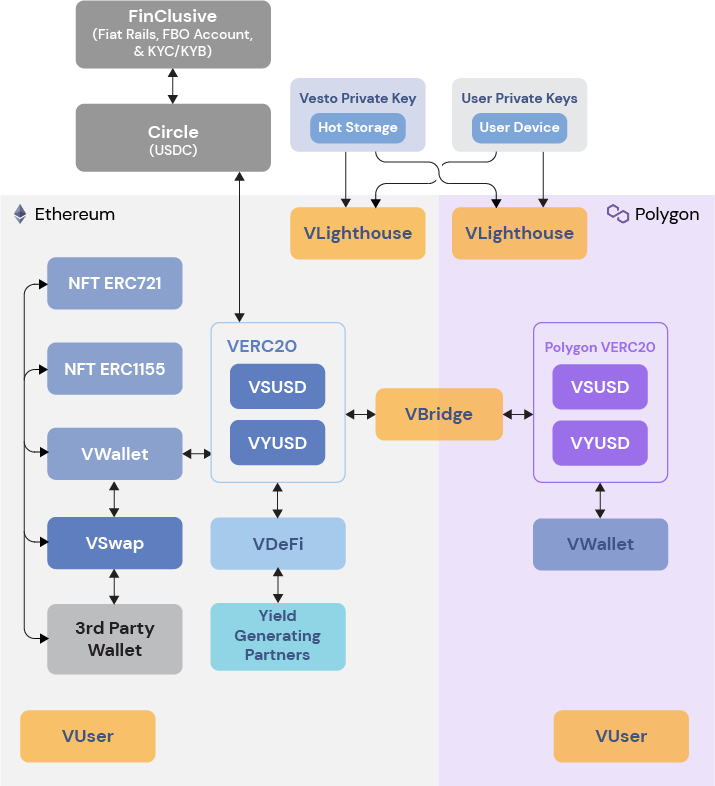

Vesto’s Service Architecture

So how do these three tiers of Vesto’s infrastructure work together? They collectively enable Vesto’s Service Architecture, which provides for the on- and off-ramping of crypto and fiat currencies by known entities, which can then have their deposited crypto assets leveraged to generate investment yields in a cross-chain transaction workflow that provides higher performance and scaling while reducing transaction costs. The architectural design below shows the services and workflow paths provided through the Vesto platform, including cross-chain transactions and seamless integration with partner services. Vesto’s Service Architecture has many unique attributes, from the generation of VTokens across blockchain protocols, the minting of other ERC-20 tokens, and invoking best-of-breed crypto services.

When customers invest the USDC in their Ethereum-based VWallet in a Vesto DeFi option, Vesto manages their investment in its DeFi partner with Vesto’s VDeFi protocol. When they invest these assets in a Vesto CeFi option, Vesto’s regulated CeFi partner manages their investment directly. In both cases, Vesto mirrors and tracks those investments with newly minted VTokens in these customers’ Polygon-based VWallets, and manages all transactions into and out of both of their Ethereum and Polygon-based VWallets on-chain, creating an immutable record of each transaction. Because Vesto built and controls its own core code, it can also make modifications and extensions to its Service Architecture when needed.

Use Cases for Leveraging Vesto’s Platform

Vesto’s architecture has been designed from the ground up to provide a secure, highly performant, scalable, transparent, and low-cost platform that can fulfill a broad array of use cases. The most prominent uses of the Vesto platform revolve around financial services, providing an impressive set of benefits to almost every industry vertical and possible use case. Consistent with Vesto’s guiding principle of being inclusive, Vesto’s financial services use cases are designed to support customers ranging from large multinational businesses, banks, Neo Banks and financial institutions to retail businesses, and the healthcare, art and real estate industries and more. Central to this guiding principle of inclusiveness is Vesto’s commitment to democratize access to the power of blockchain technology and cryptocurrency for everyone. Vesto’s platform enables extension of the consumer banking, Neo Bank and FinTech industry to also serve the large number of underserved or unbanked people around the world.

Vesto customers can onboard and issue a Vesto VWallet to anyone with a smartphone, access to the internet, and the ability to provide basic identity documentation. For microfinance transactions, including international remittance of funds, Vesto’s platform provides an appealing alternative to traditional payment and remittance services which typically charge high transaction fees, can take several days to process and are plagued with the risks of dealing in cash and by instances of fraud. Vesto can facilitate remittance services instantly between VWallets and provide fiat currency on and off-ramp services at the speed of the local financial institution which is disbursing funds.

In addition to these benefits, any crypto funds left on deposit by customers and end-users transferring funds or sending remittances will typically earn the depositor much higher yields than with traditional savings accounts, without minimum balance requirements, mandated lock-in periods or hidden, convoluted transaction fees. Vesto’s high yield multi-token DeFi and CeFi services scale from these individual deposits up to institutional investment and businesses’ asset management and corporate treasury applications. Yields are calculated daily and continue growing until the DeFi and CeFi deposited assets are withdrawn, making Vesto an excellent way to maximize earnings on float or assets at rest. Businesses can create sub-accounts to track their client and end-user deposits and have multiple levels of sign-on controls. Full records of all Vesto transactions are available through their VWallets and Vesto’s User Interface.

VESTO INDUSTRY VERTICALS AND USE CASES

- Corporate Treasury Investments: Enables businesses to maximize yields on corporate investments and cash management accounts by allocating funds to Vesto’s regulated CeFi partners utilizing traditional asset-backed investment opportunities with high APYs, and with all participants having undergone KYC, KYB and AML verification.

- Payment Processing: Supports integration of online and brick-and-mortar storefronts with crypto payment services providing fast, inexpensive payments and collections for all sizes of businesses, as well as access to high yields on float and on their clients’ and end-users’ accounts.

- Tokenization of Securities and other Real-World assets: Vesto’s tokenization engine can produce tokens representing traditional funds and other financial products, as well as a wide range of real world assets, opening a worldwide marketplace for these assets and related business and investment opportunities.

- Banks, FinTechs, Challenger Banks and Neo Banks Enables the full array of blockchain and crypto-related services for these businesses and their clients. Vesto’s complementary infrastructure also supports their efforts to gain regulatory approval to be agents and custodians of digital assets, and to mint and market digital securities.

- Large and Multinational Businesses: Enables full access to the worldwide blockchain and crypto ecosystem, including fast, low cost movement of assets, payment processing across borders, currency exchange and hedging, high yielding CeFi and DeFi investment options, the ability to tokenize and market previously illiquid assets, and to use NFTs and smart contracts in supply chain management.

- Healthcare Companies and Insurers: Empowers fast, inexpensive payment processing and enables use of CeFi and DeFi accounts to boost yields on corporate treasuries and required reserves, and on private and public accounts established for the care of patients, research cohorts and populations.

Conclusion:

Vesto has created a comprehensive enterprise ready end-to-end solution that makes the entire world of blockchain technology, digital assets, and e-commerce easily available. With Vesto, fast, efficient global transactions and remittances are accessible to all types and sizes of businesses and their end-users through simple to operate mobile and web-based Apps 24/7 at a fraction of previous costs. Vesto’s customers have instant access to the most advanced DeFi and CeFi services through which they can instantly transact business worldwide and earn previously unavailable high yields on their deposited assets from a variety of investment options.

Our state-of-the-art technology is implemented on the Ethereum and Polygon networks, and has the flexibility to operate on multiple other blockchains and manage efficient multi-cross-chain transactions. Our unique multi-token protocol for decentralized and centralized services, combined with our ability to do batch transfers cross-chain, decreases blockchain congestion and gas fees, while ensuring that our customers’ assets can be rapidly put to their most efficient and effective use. And our tokenization engine allows customers to mint, market and transfer security tokens and other tokens representing a wide range of securities and assets.

Most importantly, all these benefits come with the security and peace of mind made possible by Vesto’s proprietary Multisig VWallet protocol, KYC, KYB and AML screening, and encrypted on-chain processing. Vesto has eliminated the risks of lost private keys through its encrypted customer controlled key recovery process, and has eliminated the headaches many have had trying to transact with cryptocurrency by making all our customer and end-user interfaces user friendly and intuitive. Anyone with a mobile phone and internet access can now have the power of the most advanced institutional traders and investors in their hands at any time of day or night. Lastly, Vesto’s AWS cloud-based client and partner interfaces and integration support make onboarding of customers, their end-users, and new partners an easy process; and our best-of-breed partnering strategy assures customers always have access to the best state-of-the-art technology.

A brief review of Vesto’s 6 guiding principles and the wide range of current and potential industry verticals and use cases our platform supports, all discussed above, well demonstrates Vesto’s technology leadership in today’s marketplace. We invite the readers of this publication to consider how Vesto might fit into your, or your businesses’ plans. For more information about Vesto, visit https://vesto.io; or contact Jill Krebs, Vesto’s Marketing Manager, at jill.krebs@vesto.io. Our entire team looks forward to welcoming you into our growing list of satisfied customers, partners and investors.

Disclaimer: The opinions, analysis, forward looking statements, and the technology and product descriptions discussed here do not constitute investment advice. They represent our current understandings and best judgments at the time they were written and are subject to change or updates over time. This publication was originally posted on November 15, 2021, and updated on March 1, 2022 and January 15, 2023. Visit https://vesto.io/reports for any further updates and other Vesto reports.

*************************

- 1vWallet is Vesto’s proprietary non-custodial smart wallet which can hold a wide range of digital assets. While Vesto provides custodial governance, multi-sig access controls and administrative services, users own their vWallet accounts and retain unique private keys, giving them sole control over their assets

- 2Business to business, peer to peer, business to customer/employee, and customer to business transfers.

- 3On-chain means transactions are executed and recorded on blockchain and a record of that is added to every participant’s ledger, making it virtually impossible to change, hack, or cheat the system.

- 4vTokens are Vesto’s proprietary minted tokens representing users’ digital assets on other networks, like Polygon